new york salt tax workaround

Year-End Tax Deal Could Significantly Boost Trumps Corporate Tax Cuts At the time it was enacted the 2017 tax law was projected to cost 15 trillion over a decade. The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap.

Updated Guidance The Pass Through Entity Tax In New York State Overview And Faq Marks Paneth

New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

. New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline. 16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability. The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017.

The PTE election deadline for New York State is October 15 2021. Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently. Friday December 18 2020.

The assembly and senate have passed the budget. The New York State legislature and NYS Governor Cuomo reached an agreement for the fiscal year 20212022 state budget. Connecticuts pass-through entity PTE tax for the SALT cap workaround is mandatory which is unique.

This so-called workaround benefits individual taxpayers for federal tax purposes in two ways. Individual PTE owners who would have been subject to the 10000 SALT. The Pass-Through Entity tax allows an eligible entity.

The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. In addition to the PTET changes some of the other key highlights to the budget bill includes. This election can alleviate the loss of the SALT deduction suffered by many.

New Yorks SALT Workaround. Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through. A small business may elect to pay tax at the entity level and a.

Remember the deadline to elect into New. An owner of the electing entity is entitled to a credit against hisher City personal income tax equal to the owners direct share of City passthrough entity tax PTET paid. The deadline to elect into New Yorks entity-level tax workaround to the federal SALT cap is October 15 2021.

New York State is expanding a tax break that allows smaller companies to circumvent the 10000 limit on state and local tax deductions from the 2017 Tax Cuts and. April 15 2021 On April 7 2021 the New York State Legislature passed the 2021-22 budget bill which is expected to be signed by Governor Cuomo and enacted in its present. New York State 20212022 Budget Act SALT Cap Workaround The New York State NYS 20212022 Budget Act was signed into law on April 19 2021.

Beginning after 2022 the tax rate for married filing. Learn about New Yorks pass-through entity. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

The PTET provisions in California and New York generally follow the standard SALT cap workaround formula. Other Budget Bill Highlights. On April 6 2021 New York Gov.

Will New Jersey S Salt Deduction Work Around Help Its Small Business Owners

Reassessing Some Salt Deduction Workarounds Certified Tax Coach

Salt Deduction Tax Increase New York Trump Tax Bill

Pass Through Entity Salt Cap Workaround Lancaster Cpa Firm

Salt Cap Workaround Gets Green Light From Irs Fox Business

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

Salt Deduction Cap Stays In Place After Supreme Court Rejects New York Challenge Crain S New York Business

California Taxpayers To Benefit From Expanded Salt Cap Workaround Corporate Breaks Mgo

How States Are Letting Small Businesses Avoid The Salt Cap On Their Tax Returns

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Judge Dismisses States Challenge To Salt Deduction Limit Don T Mess With Taxes

The Death Knell For Salt Cap Workarounds The Cpa Journal

New York Rolls Dice On Salt Workaround

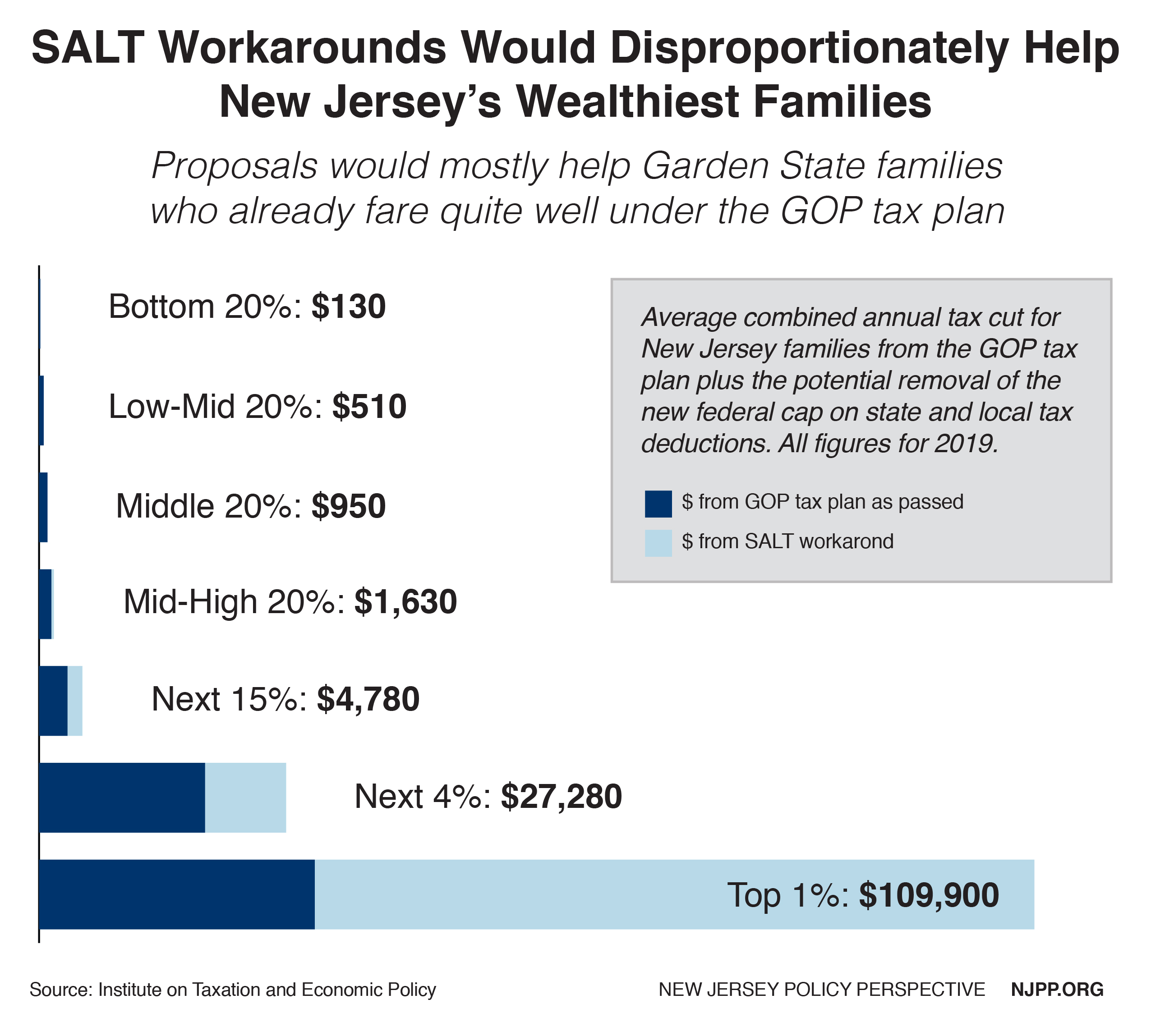

A Grain Of Salt New Jersey Needs More Than Workarounds To Respond To Gop Tax Plan New Jersey Policy Perspective

New York S Salt Workaround New Guidance Affected Industries And What To Know Before The October 15 2021 Deadline Insights Venable Llp

N Y Salt Cap Fix Tucked Into Budget Delivers Broader Tax Break

States Continue Court Fights Over Salt Deduction Limit Don T Mess With Taxes

Highlights Of The New York State Pass Through Entity Tax Prager Metis

Salt Limitation And The New York State Pass Through Entity Tax Ptet By Adam E Panek Cpa Partner Grossman St Amour Cpas Pllc